Why the Growing Number of Homes for Sale Is Good for Your Move Up

Are you thinking about selling your current home? If so, the biggest question on your mind may be: if I sell now, where will I go? If this resonates with you, there’s something you should know. The number of homes coming onto the market is increasing and that could make it easier for you to move up this summer.

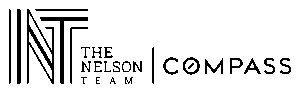

According to the latest data from realtor.com, the number of homes being listed for sale, known as new listings, has increased consistently this year (see graph below):

While this news has clear benefits for buyers who are craving more options for their home search, what does that mean for current homeowners like you? It gives you two distinct opportunities in today’s housing market.

Opportunity #1: Take Advantage of More Options for Your Move Up

If your current house no longer meets your needs or lacks the space and features you want, this gives you even more opportunity to sell and move up into the home of your dreams. As more options come to market, you’ll have more to choose from when you search for your next home.

Partnering with a local real estate professional can help make sure you see these listings as soon as they come onto the market. And when you do find the one, that professional can advise you on how to write a winning offer to seal the deal.

Opportunity #2: Sell Before You Have More Competition

Just know that, in order to make sure your house shines above the rest, it may make sense to put your home up for sale before your neighbors do the same, creating more competition in your area. The increase in the number of homes being listed for sale is expected to continue, and a recent study from realtor.com says two-thirds of homeowners looking to sell say they’ll do so by August.

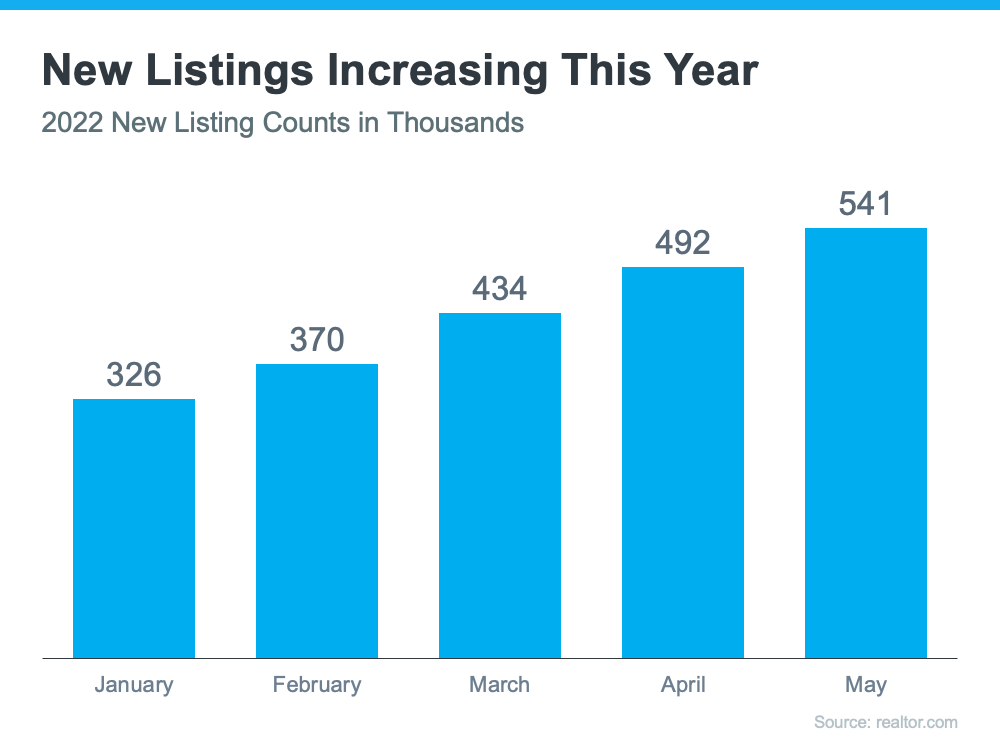

A real estate professional can advise you on what you need to tackle to get your house ready to list so they can put that for sale sign up in your yard sooner rather than later. That’s because the process of getting a home ready to sell isn’t taking as long as you may think. As a result, you can capitalize on today’s sellers’ market and get ahead of the competition.

Bottom Line

If you’re a current homeowner looking to sell, let’s connect to begin the process. You have a unique opportunity to benefit from the additional homes being listed today and sell before your house has more competition.

![History Proves Recession Doesn’t Equal a Housing Crisis [INFOGRAPHIC] | Simplifying The Market](https://denverlivinghomes.com/wp-content/uploads/2022/06/20220603-KCM-Share-549x300-1.png)

![History Proves Recession Doesn’t Equal a Housing Crisis [INFOGRAPHIC] | Simplifying The Market](https://denverlivinghomes.com/wp-content/uploads/2022/06/20220603-MEM-2.png)

![Bright Days Are Ahead When You Move Up This Summer [INFOGRAPHIC] | Simplifying The Market](https://denverlivinghomes.com/wp-content/uploads/2022/05/20220527-KCM-Share-549x300-1.png)

![Bright Days Are Ahead When You Move Up This Summer [INFOGRAPHIC] | Simplifying The Market](https://denverlivinghomes.com/wp-content/uploads/2022/05/20220527-MEM.png)

Follow Us!