Don’t Make These Mistakes When Selling Your House

Are you thinking about selling your house? Some common mistakes today can make the process more stressful or even cost you money.

Fortunately, they’re easy to avoid, as long as you know what to watch for. Let’s break down the biggest seller slip-ups, and how an agent helps you steer clear of them.

1. Overpricing Your House

It’s completely natural to want top dollar for your house, especially if you’ve put a lot of work into it. But in today’s shifting market, pricing it too high can backfire. Investopedia explains:

“Setting a list price too high could mean your home struggles to attract buyers and stays on the market for longer.”

And your house sitting on the market for a long time could lead to price cuts that raise red flags. That’s why pricing your house right from the start matters.

A great real estate agent will look at what other homes nearby have sold for, the condition of your house, and what’s happening in your market right now. That helps them find a price that’s more likely to bring in buyers, and maybe even more than one offer.

2. Spending Money on the Wrong Upgrades

The housing market has nearly a half million more sellers than buyers according to Redfin. That means you have more competition as a seller and may have to do a bit more to get your house ready to sell. But not all projects are going to be worth it. If you spend money on the wrong projects, it could really cut into your profit.

A local real estate pro knows what buyers in your area are really looking for, and they can help you figure out which projects are worth it, and which ones to skip. Even better, they’ll know how to highlight any upgrades you make in your listing, so your house stands out online and gets more attention.

3. Refusing To Negotiate

Now that inventory has grown, it’s important to stay flexible. Buyers have more options – and with it comes more negotiating power. U.S. News explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

That’s where your agent comes in. They’ll help you understand what buyers are asking for, what’s normal in today’s market, and how to find a win-win solution. Sometimes making a small compromise can keep the deal moving and help you move on to your next chapter faster.

4. Skipping Research When Hiring an Agent

All of these mistakes are avoidable with the help of a skilled agent. So, you want to be sure you’re working with the right partner. Still, according to the National Association of Realtors (NAR), 81% of sellers pick the first agent they talk to.

Many homeowners may skip basic steps like reading reviews, checking sales history, and interviewing a few agents. But that’s a mistake. You want someone you know you can rely on – someone with a good track record. The right agent can help you price your house right, market it well, and sell it quickly (and maybe for more money).

Bottom Line

Selling a house doesn’t have to be stressful, especially if you have an experienced agent by your side. Connect with a local agent so you have an expert to help you avoid these common mistakes and make the most of your sale.

What’s one thing you’d want expert advice on before putting your house on the market?

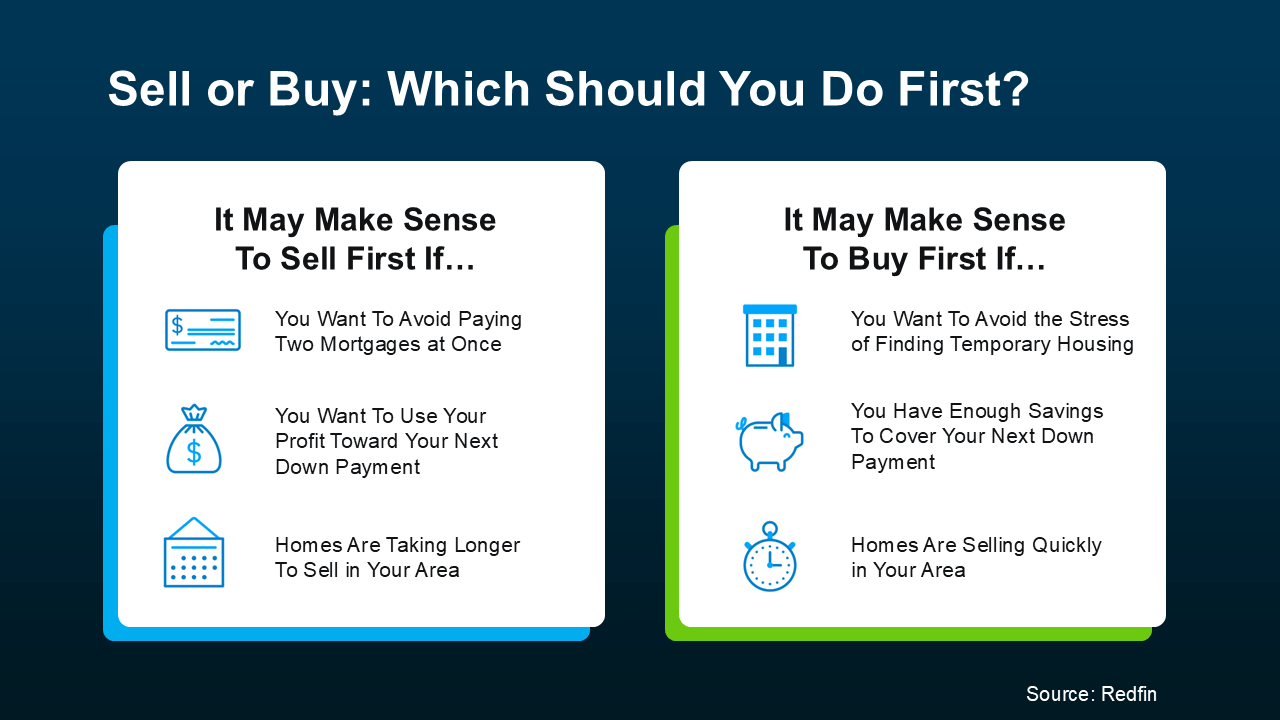

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

Follow Us!