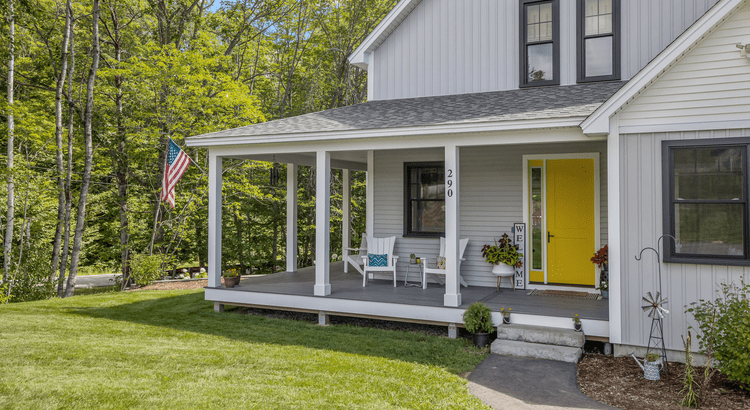

Homeowners Gained $28K in Equity over the Past Year

If you own a home, your net worth has probably gone up a lot over the past year.

This author has not written his bio yet.

But we are proud to say that bradleymayhew contributed 1168 entries already.

If you own a home, your net worth has probably gone up a lot over the past year.

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting.

If your listing expired and your house didn’t sell, it’s totally natural to feel a mix of frustration and disappointment.

![Housing Market Forecast for the 2nd Half of 2024 [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240627/Housing-Market-Forecast-for-the-2nd-Half-of-2024-KCM-Share-original.png)

Wondering what the second half of the year holds for the housing market? Here’s what expert forecasts say.

When you decide to buy your first home, you may come across a number of terms and conditions you’re not familiar with.

Should you buy a home now or should you wait?

You want your house to sell fast. And you may be wondering how long the whole process is going to take.

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

Considering selling your house without an agent? You should know there are some serious downsides to handling it on your own.

Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season.

720-933-8232

Follow Us!